Thanks to all who commented favorably on 4L’s recent blog concerning internal accounting controls in law firms (Embezzlement Happens! In Law Firms, too!) or on our Internal Control Checklist questionnaire. I particularly appreciated the many law firm war stories some of you shared.

The 2018 Global Study on Occupational Fraud & Abuse published by the Association of Certified Fraud Examiners (“ACFE”) examined 2,690 incidents of occupational fraud between January 2016 and October 2017, spanning 125 countries. It is a fascinating read, but for those of you who do not have time to digest the entire 80-page analysis, this is a summary of my top 10 takeaways.

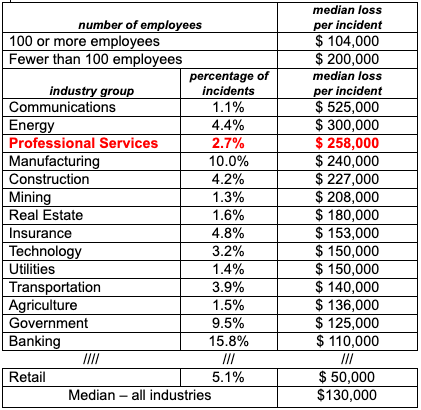

1. Organizations Most Vulnerable to Occupational Fraud

Small entities, including professional service entities, are more vulnerable to occupation fraud than larger organizations. This is likely due to smaller entities having fewer resources available for fraud prevention and detection measures. While Professional Service organizations incur fewer incidents of occupational fraud, they are among the costliest. This is not surprising since “professionals” tend to eschew management tasks and instead rely on “trust” rather than day-to-day supervision or putting systems into place.

Table 1 – FRAUD BY SIZE AND INDUSTRY GROUP

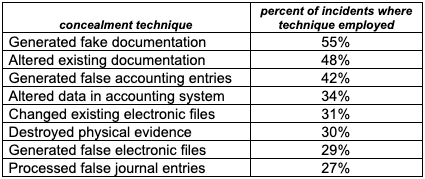

2. Concealing Occupational Frauds

In 97% of the reported incidents, the perpetrators engaged in one or more activities to conceal and perpetuate their fraudulent schemes.

Table 2 – Top 8 Fraud Concealment Methods

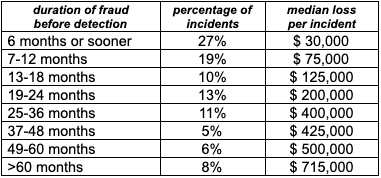

3. Duration of Different Types of Fraud

The median lifespan of fraud was 16 months from inception to detection. Not surprisingly, the longer the fraud continues, the higher the median loss incurred.

Table 3 – Prompt Detection of Fraud Reduces Loss

4. Typical Professional Service Fraud go Undetected Longer

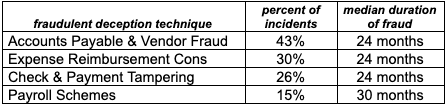

Certain types of fraud tends to take longer to detect than others. Coincidently, these four also are the most prevalent types of occupational frauds occurring in the professional service organizations.

Table 4 – Percentage of Incidents and Median Duration of Frauds on Professional Service Organizations

5. Profile of a Perpetrator of Occupational Fraud

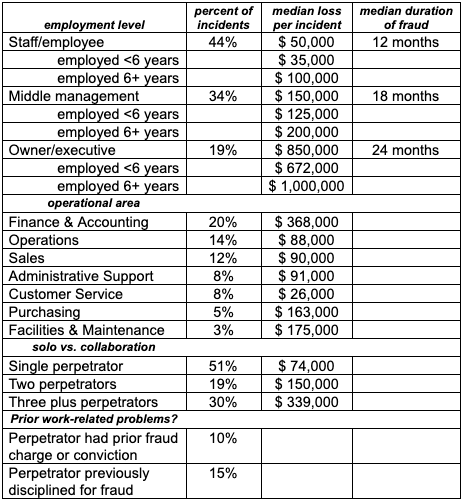

The statistics indicate the losses tend to increase based upon the fraudster’s role in the organization hierarchy, tenure, and whether the fraud was committed alone or in collaboration with others to circumvent anti-fraud measures devoted to separation of duties and independent checks and balances.

Table 5 – Profile of a Perpetrator & Their Impact

6. Most Common Telltale Behavioral Signs of Occupational Fraud

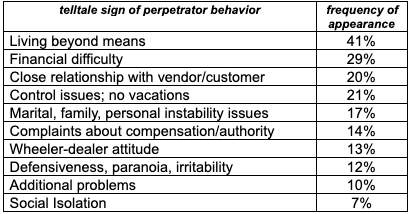

In 85% of the incidents, the perpetrator displayed at least one behavioral red flag at work; in half the cases, multiple red flags were exhibited.

Table 6 – Top 10 Behavioral Red Flags Exhibited

7. Background Checks

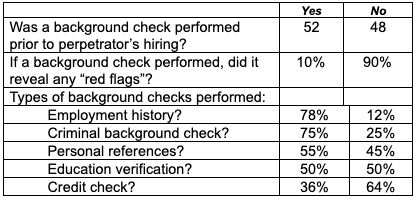

Preventing occupational fraud begins with hiring an ethical workforce, yet nearly half the perpetrators in the 2,690 incidents were hired without background checks. In 10% of the cases where a background check occurred, a “red flag” appeared, but the eventual perpetrator was hired anyway.

Table 7 – Background Checks on Perpetrators

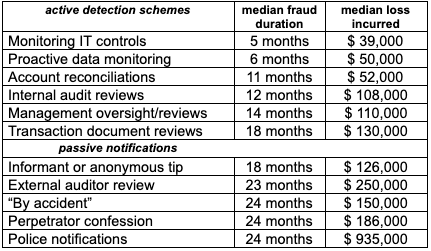

8. Early Detection Reduces Losses

ACFE attempted to demonstrate the link between early detection of fraudulent and loss experience. No surprise: “active” anti-fraud detection systems and procedures were more effective in reducing temptation and means – as well as losses – than simply ignoring the issue or depending upon goodwill and trust.

Table 8 – How Early Detection, Fraud Duration and Loss Experience

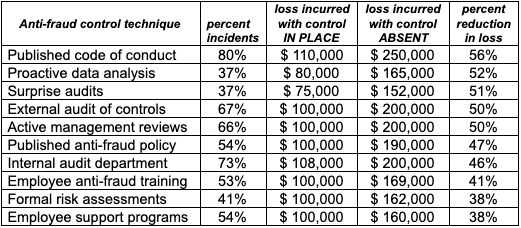

9. Cost/benefit of Active Anti-fraud Initiatives

Although the cost/benefit of active anti-fraud control measures is difficult to demonstrate, ACFE presented an interesting analysis suggesting “active” anti-fraud measures do play an important role in deterring occupational fraud. They looked at various incidents and compared the median loss incurred in situations where any of 18 different anti-fraud control measures were present or absent in the workplace. Across-the-board, the median loss experienced was less (often nearly by half) when specific anti-fraud measures had been implemented by the victim organization – i.e., doing something is preferable to doing nothing.

Table 9 – Analysis of Top 10 (Non-financial Statement) Anti-fraud Control Techniques and Comparison of Median Loss when Specific Anti-fraud Control IN PLACE versus Control ABSENT in the Victim Organization

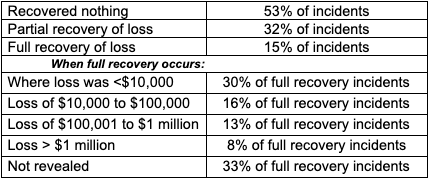

10. Results of Occupational Fraud Incidents

In calendar year 2018, 58% of the incidents were referred to law enforcement and 23% of the time the victim organization filed a civil suit to recover its losses. However, it should be noted that criminal referrals declined by 16% over the last decade, citing fear of adverse publicity as the principal reason organizations chose to remain mum about occupational frauds. Recovering losses from occupational fraud generally proves problematic.

Table 10 – Recovering Losses following Occupational Frauds

The AFCFE report is good reading for those of you interested in how occupational fraud occurs, how to detect it, and measures your organization can employ to protect against it. Clearly, the axiom “an ounce of prevention is worth a pound of cure” is as true today – in the context of asset preservation – as it was when Ben Franklin reportedly uttered the phrase when promoting fire safety.

Even the simple act of scheduling time with your accounting department personnel to talk through 4L’s Internal Control Checklist will raise awareness of internal accounting controls in the workplace. I understand how busy most law firm managers are, but recommend you find time to download and read the ACFE report; if not, hope you found this posting helpful.